Contents:

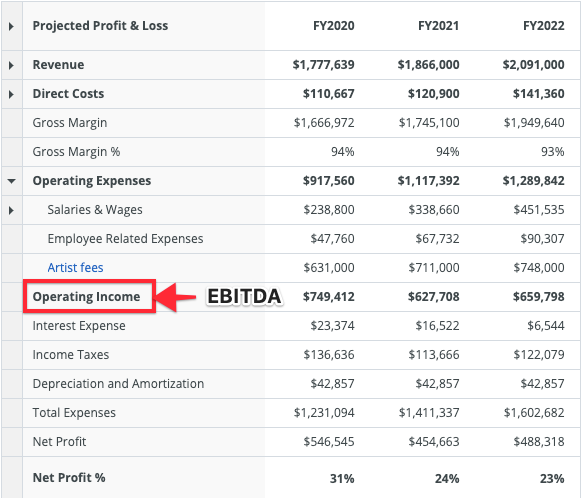

To assess your performance, compare your turnover ratio to other firms in your industry. The goal is to increase the numerator , while minimizing the denominator . In a perfect world, a business can increase credit sales to customers who pay faster, on average.

free interest checking accounts -【how to set up loan receivable in … – Caravan News

free interest checking accounts -【how to set up loan receivable in ….

Posted: Mon, 24 Apr 2023 21:06:10 GMT [source]

The receivable account, on the other hand, represents amounts your business is owed. Furthermore, the Allowance for Doubtful Accounts is recorded as a Contra Account with Accounts Receivable on your company’s balance sheet. The Allowance For Doubtful Accounts is nothing but the estimate of accounts receivable not expected to be paid by the customers for goods sold on credit to them. Further, on the day when the payment is received, Ace Paper Mills will record such a receipt of payment in the following manner. Cash Account would be debited by $198,000, Sales Discount and Allowances Account would be debited by $2,000, and Accounts Receivable account would be credited by $200,000. The Purchases account would be debited by $200,000 and the accounts payable account would be credited by $200,000.

We use Accounts Receivable (A/R) to keep track of money that customers owe to us. A/R aging is a great report that lists unpaid customer invoices and unused credit memos by specific date ranges. As a result, we can utilize A/R to show us the cash expected to be received in the future. As business owners selling a good or service to our customers, oftentimes, we need to send Estimates or Quotes.

Popular QuickBooks Tutorials

Choose the payments which are to be deposited and select the bank account which the deposit is to be made to. In this step, choose the invoice that you wish to apply for this payment on. In the first step, navigate to the create menu and choose the invoices and click on new invoice. Now, move back to customer and click on create Sales Order option and fill the required information and hit on save and close. It helps the user to send forms directly to debtors as a reminder about payments.

If you uploaded a logo while setting up your company information, you can opt to show your logo at the top of your A/R aging report. This customization allows you to filter the aging report based on two variables, customer and location. Select Reports in the left menu bar and scroll down to the Who owes you section. Then, select Accounts receivable aging summary from the report options. A quick way to find out if you have unapplied payments or credits in your Accounts Payable or Accounts Receivable system is to run a Balance Sheet report on a Cash Basis.

To help, you can change the ‚receive payment‘ transactions and uncheck all the payment applications. When all the payments have been unapplied, you can rematch invoices with payments correctly. Generate a credit memo of $1,000 to Company B and charge it to the AP/AR Offset account. Once generated, you will be ready to record and create your payment of the Net balance due to Company B. Accounts receivables are usually created for a short period of time. You can easily manage AR in QB, but for that, you should know how to adjust accounts receivables in QuickBooks Desktop.

How to Void an Invoice in QuickBooks

Furthermore, the accounts receivable tracking feature also simplifies the reconciliation process by providing built-in tools that allow businesses to easily match payments with invoices. The ability to easily set up an accounts receivable account in QuickBooks enables businesses to stay organized and efficiently manage their customer accounts in one place. Invoiced is a cloud-based accounts receivable automation system designed to help businesses get paid faster and reduce time spent on billing and collections.

Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more. For selecting the file, click on „select your file,“ Alternatively, you can also click „Browse file“ to browse and choose the desired file. You can also click on the „View sample file“ to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on „next,“ which shows your file data.

Also, you can simplify and automate the payroll accounting using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it’s done. Fill out the “Opening Balance” and “As of” sections with the client’s unpaid balance, if any. When adding the customer’s details, avoid entering data in the “Opening Balance” and “As of” boxes if you are tracking many jobs for the same customer.

Net Realizable Value of Accounts Receivable

But the real value comes in the accounting reports you can view. In QuickBooks Online, you can break out A/R reports by customer, by days overdue, and overall. Depending on what your results reveal, you may need to ramp up collection activities with some customers or revise payment terms.

In the first step, you are required to launch QuickBooks and hit on the “Lists” menu option and choose the Chart of Accounts. After that, from the top of the customer center menu choose New Customer & Job and select New Customer. Once the above steps are done now enter the memo if required as the memo will make the entry more comprehensive. Now, fill the information for the sale items or services and in the end click on save and close. You can use a number of strategies to increase cash collections and reduce your receivable balance. So, you need to set aside some amount of money as an allowance for doubtful accounts.

Negative amounts on your Accounts Receivable reports?

Accounts receivable is an important asset in any business’s balance sheet. It shows how much money customers owe your company for goods or services they have purchased from you in the past. Under accrual basis accounting, it is recorded as an asset and falls under the ‘current assets’ section of your company’s balance sheet or general ledger. Accounting softwareshould provide an aging schedule for accounts receivable, which groups your receivables based on when the invoice was issued.

- Such a credit sale is recorded as accounts receivable in your books of accounts.

- Once selected and confirmed, the AR balance will be zeroed out and accounts payable can be addressed.

- Thus, bigger the difference between Gross Receivables and Net Receivables, bigger the issue with your business’ trade credit and collection policy.

- The most useful tool for monitoring receivables is the accounts receivable turnover ratio.

Offer your clients a discount (1% to 2%), if they pay within 10 days. You’ll lose some revenue with these payment terms, but you’ll collect some cash faster. Firms that are typically paid over a period of months will have a larger dollar amount of receivables in the 60-day category. This is another report that should be compared to industry averages.

In the first section, you can customize general settings, such as the reporting period and number format. What is a cost-plus contract and how is it used in the construction industry? We envision a world where no one in construction loses a night’s sleep over payment.

Avery Martin holds a Bachelor of Music in opera performance and a Bachelor of Arts in East Asian studies. As a professional writer, she has written for Education.com, Samsung and IBM. Martin contributed English translations for a collection of Japanese poems by Misuzu Kaneko.

where to gt 12,000 dollars for a student loan -【when is my student … – Caravan News

where to gt 12,000 dollars for a student loan -【when is my student ….

Posted: Mon, 24 Apr 2023 21:44:44 GMT [source]

QuickBooks is the ideal solution for organizing, managing, and analyzing your business’s finances. QuickBooks Online allows you to create multiple A/R accounts, however, it’s not designed to work with them. In addition, the initial A/R account created will be its default in tracking A/R balances. For this reason, we can’t change the default A/R account assigned by QuickBooks.

Using this method matches revenue earned with the expenses incurred to generate the revenue, and the process presents a more accurate view of your profitability. The income statement is more reliable when you use the accrual method. Typically, you as a business owner sell goods on credit to your customers. Now, extending trade credit to your customers has a default risk attached to it. In other words, there may be certain customers who may not pay cash for the goods purchased on credit from you. Net Accounts Receivable is the total amount that your customers are liable to pay less the money that is doubtful to be collected from such customers.

Monthly you can click to „send A/R data“ when prompted on the first of each month or by manually selecting the D&B Trade Exchange option in the file menu. You can review the outstanding A/R details before sending D&B the monthly report to remove clients who show up as past due because you have extended their terms. D&B also offers participants free invoice stickers, available physically and digitally. Some companies use this as a competitive advantage, taking the approach of „Do business with me and pay on time, and you’ll also boost your business credit score.“ As a seller, you must be careful in extending trade credit to your customers.

- If you don’t have retainage withheld from your payments, you may be able to use the standard accounts that QuickBooks provides.

- You can generate the reports using the accounts receivable account post navigation to the chart of accounts.

- In the construction business, everything comes down to the contract.

- For keeping track of the asset, record the amount as a receivable in your accounting books.

- Apparently,there is an option in QuickBooks that you can add more than one accounts receivable accounts to the chart.

Click Save and Close and you will see an Available Credit message. When asked what you would like to do with the credit, select Apply to an invoice and click OK. Set up aServiceitem code titled AP/AR Offset, and have the item code account assigned to the AP/AR Offset account you set up in Step 1. In your Chart of Accounts, create an account titled AP/AR Offset and label it under the ‘Expense‘ account type. Get solutions to all of your accounting and bookkeeping problems with industry-leading experts. In this article learn how to fix the QuickBooks not enough memory issue and follow the steps to enter home …

Typically, you sell goods or services on credit to attract customers and augment your sales. Accounts Receivable is a form stating the amount that an organization is entitled to, from a client or customer. If you don’t then no worries, here we will discuss the step-by-step process on how you can exactly do so all with ease. Here you want to print out a “Vendor Balance Detail” from the Reports menu – Vendors & Payables.